“Westinghouse files for bankruptcy, in a blow to nuclear power industry” by Steven Mufson

by

Site Admin on

Mar 29, 2017 •

10:12 am No Comments

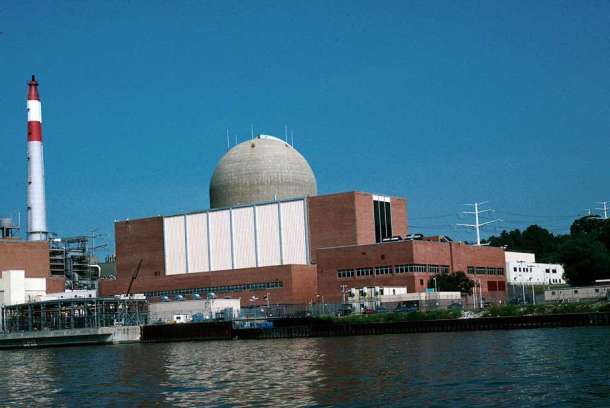

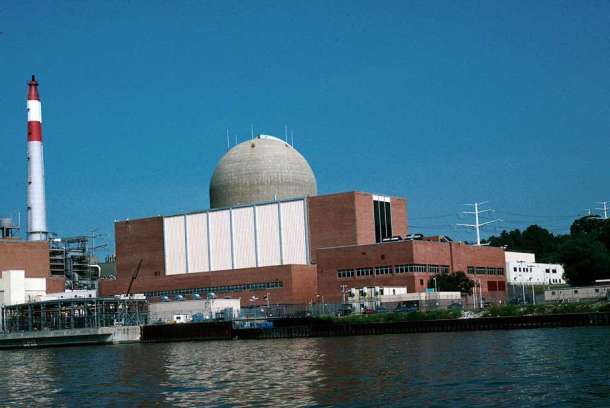

“The Indian Point nuclear power plant in Buchanan, New York, operates two Westinghouse PWR units and one shutdown unit. Toshiba’s U.S. nuclear unit, Westinghouse, has filed for bankruptcy protection, the companies said Wednesday

WASHINGTON — Westinghouse, one of the most storied names in the nuclear energy business, filed for bankruptcy Wednesday, dealing a blow to the future of the nuclear power industry and leaving question marks about the future of four reactors currently under construction in the United States.

The filing also brings to an end the marriage of Westinghouse and Toshiba. When the Japanese giant — maker of everything from medical devices to home appliances — bought the Westinghouse nuclear business in October 2006, it declared “the dawn of a new era for nuclear energy.” Together the companies would make a “powerful combination,” Toshiba said.

A decade later, that combination has melted down. Toshiba has written off more than $6 billion in losses connected to its U.S. nuclear business, citing accounting problems, delays and cost overruns. And it has pulled back from new nuclear projects under discussion in India and Britain.

The bankruptcy filing Wednesday will trigger a host of legal questions about whether Toshiba remains responsible for losses at Westinghouse and whether the utilities that own the reactors under construction will have to eat more of the cost of completing them. That could mean higher rates for consumers in those areas. In seeking protection under Chapter 11 of the bankruptcy act, Westinghouse could still finish building those plants.

Westinghouse said it has arranged $800 million in debtor-in-possession financing so that it can continue to service customers while restructuring its business.

The collapse of Westinghouse also reverberates through the global nuclear business. Westinghouse supplied the world’s first commercial pressurized water reactor 60 years ago and half the world’s 430 nuclear power reactors have Westinghouse technology.

Moreover, Westinghouse had claimed that its new AP1000 model reactor had passive technology and modular design that was safer, cheaper and faster to build. Many U.S. lawmakers and nuclear industry officials say the AP1000 could augur in a “nuclear renaissance” in the United States.

Westinghouse is currently in charge of construction of four of these new model reactors at two different sites. The first two are being built by SCANA at the Virgil C. Summer Nuclear Generating Station, a site about 20 miles northwest of Columbia, S.C. State-owned utility Santee Cooper is a partner on the project. The other two, backed by Energy Department loan guarantees, are being built at the site of Southern Co.’s existing Vogtle facility.

Yet Westinghouse ran into trouble on both sites. Though the AP1000 was supposed to be a standard design, changes were made in South Carolina. Moreover, Westinghouse plans included modules built in Lake Charles, Louisiana, that were supposed to fit together “like pieces of Lego,” said a former regulator. But Nuclear Regulatory Commission files say the Lake Charles plant was shipping faulty modules, forcing Westinghouse to reweld them at the reactor sites. An entire extra building was erected to do the welding because there was so much of it, according to one person familiar with the construction.

Angry over the delays and cost overruns, the owners of the nuclear plants filed claims against Westinghouse. A settlement was reached, but now the legal battles will begin again. However, the electric utilities involved with the project say they’re committed to finishing it despite the bankruptcy.

South Carolina Gov. Henry McMaster said Wednesday he’d discussed the situation with U.S. Energy Secretary Rick Perry.

Southern Co.’s subsidiary Georgia Power, one of the co-owners of the Vogtle reactors, said it has been preparing for a Westinghouse bankruptcy and that it was “working with Westinghouse to maintain momentum at the site.” It said it was still assessing the effect of the bankruptcy and would consult with the Georgia Public Service Commission and its partners “to determine the best path forward.” It added that it would seek to hold Toshiba and Westinghouse accountable.

Both South Carolina and Georgia allow utilities to charge ratepayers for power plant construction still in progress. In most states, ratepayers don’t pay until they’re getting some of the benefits. But the utilities must still get approval from their public service commissions, which have forced the utilities to absorb some of the costs.

There are only a handful of nuclear construction contractors worldwide, and many are state-owned firms. Many are struggling; shares of the French firm Areva, for example, have tumbled 84 percent over the past five years.

The United States relies on nuclear energy to provide about 20 percent of U.S. electricity needs. Yet, the reactors, with an average age of 35, are getting old by the standards of the nuclear business.

“As these units get decommissioned, to stay at that percentage you need more units,” said Dan Aschenbach, a senior vice president at Moody’s. “But you can’t get there if you cannot construct it.”

The Westinghouse bankruptcy also ends a chapter of nuclear energy diplomacy. The U.S.-based Westinghouse, though owned by Toshiba, has won political backing in the United States in its efforts to win contracts abroad. Both the Bush and Obama administrations pressed the Indian government to buy reactors made by Toshiba-Westinghouse or Hitachi-General Electric. India was negotiating to buy half a dozen AP1000s.

But questions of liability in the event of an accident have blocked negotiations in India. And while Westinghouse is near completion of four reactors in China, it had hoped to capture a bigger share of the Chinese market. In China, too, Westinghouse has struggled with alterations in its design, delays and cost overruns.

After the March 2011 nuclear disaster in Fukushima, costs of the business have ballooned because of growing safety concerns and regulations, and a souring of sentiment toward nuclear power in some countries, such as Germany.

Toshiba has been trying to find a buyer for Westinghouse, but there are few companies able or willing to swallow Westinghouse. One possibility is Korea Electric Power Co., which already has a nuclear engineering subsidiary. The Chinese nuclear construction company might also be interested in the technology.

But KEPCO already builds its own brand of nuclear plant, and China has its own CAP 1000. Moreover, the U.S. government would have to approve any sale to another foreign company.

“There is a lot of value in that design going forward and a lot of the challenges are being dealt with right now,” said Jeffrey Merrifield, a former member of the Nuclear Regulatory Commission now at the law firm Pillsbury Winthrop Shaw Pittman. He said there were “a variety of coalitions forming” of U.S. companies that might be interested in purchasing Westinghouse. But those firms might only want certain pieces of Westinghouse, which designs a variety of reactor parts.

Another wrinkle in the Westinghouse saga is that the Energy Department provided more than $8 billion in loan guarantees to help finance the Vogtle pair of reactors. Those guarantees were given to the utilities, so the U.S. government and taxpayers should not be liable for any losses.

As for Toshiba, the bankruptcy filing is a key step in its struggles to stop the flow of massive red ink.

Toshiba has said it’s expecting a loss of $4.3 billion for April-December of last year, including a $6.2 billion hit from its embattled nuclear business. It said Wednesday it was working out revised numbers, and warned that the loss for the fiscal year may grow to $9 billion.

Toshiba has been eager to get Westinghouse off its books to improve its plight, and it said it would do just that from this fiscal year. Toshiba said Westinghouse had racked up debt of $9.8 billion.

Toshiba President Satoshi Tsunakawa said the move was aimed at “shutting out risks from the overseas nuclear business.”

“We want to make this our first step toward recovering our solid business,” he told reporters after the announcement.

Toshiba reiterated its view that at the root of the problem was the acquisition of U.S. nuclear construction company CB&I Stone and Webster. It declined comment on possible future partners in the rehabilitation of Westinghouse.

Toshiba, which has been unable to report its financial results as required, postponing it into next month, said it would monitor the rehabilitation proceedings and disclose information as quickly as possible.

Its chairman has resigned to take responsibility for the company’s troubles.

Auditors questioned Toshiba’s latest reporting on the acquisition of CB&I Stone & Webster after a whistleblower, an employee at Westinghouse, wrote a letter to the Westinghouse president.

The company’s reputation has also been tarnished in recent years by a scandal over the doctoring of accounting books to meet unrealistic profit targets.

Satoshi Ogasawara, who has written a book about Toshiba’s systematically falsifying financial results, says executives knew of the problems for years but kept procrastinating, hoping against hope that things would get better and they would be able to avoid blame. But things just got worse.

“Buying Westinghouse was the beginning of the end,” he said. “But even before that, there was a dubious corporate culture.”

Toshiba already faced problems in its personal computer business amid competition from Dell, Lenovo and HP. The drop of oil prices combined with the Three Mile Island and Fukushima accidents made nuclear power less lucrative, and plant construction kept getting stonewalled, said Ogasawara. He believes many executives responsible for the mess are still at Toshiba, without being held responsible.

The company has said it will no longer take on new reactor construction projects and will focus on maintaining the reactors it already has. But it is also involved in the decommissioning of the Fukushima Dai-ichi nuclear plant, which suffered multiple meltdowns after the March 2011 tsunami.

Toshiba has sold off so many parts of its once prized operations, such as computer chips and household appliances, it has little left but its infrastructure business.

The Associated Press contributed to this report.”

To view the complete article, click the link below: